AI computing is quietly redrawing the boundaries of crypto, finance, and high-performance computing. Brace yourself. By 2032, AI-generated revenue in finance is expected to soar past 2.7 trillion dollars. Yet, the true disruptor isn’t just financial opportunity. It’s the fusion of GPUs, quantum processors, and decentralized computing models that are rewriting the rules of what machines can tackle next.

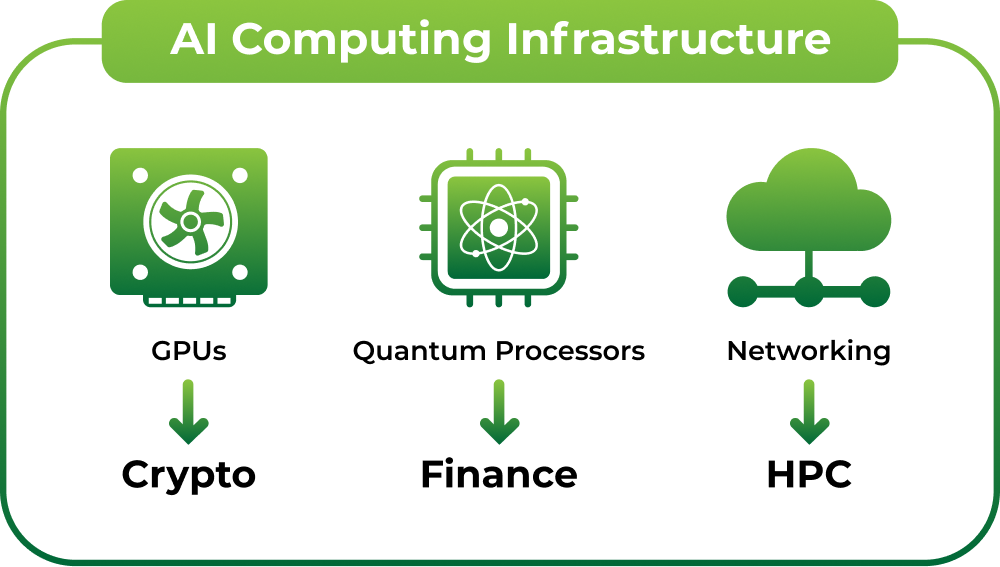

AI computing infrastructure represents the critical technological backbone that powers advanced computational capabilities across cryptocurrency, finance, and high-performance computing (HPC) domains. The architecture of these systems demands sophisticated integration of hardware, networking, and computational resources to deliver unprecedented processing power and efficiency.

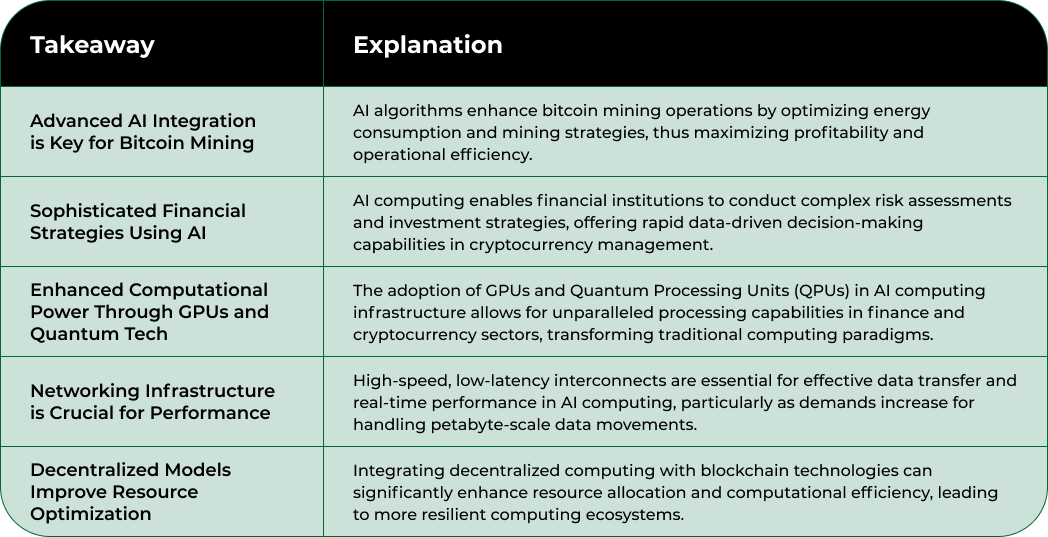

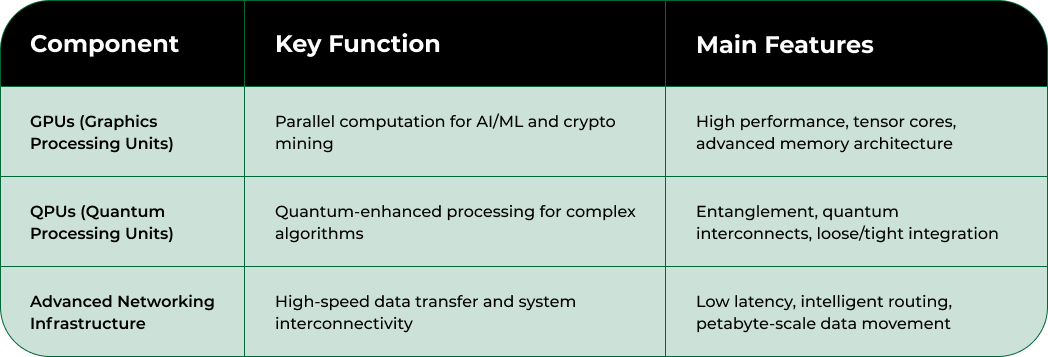

Graphics Processing Units (GPUs) have emerged as fundamental components in modern AI computing infrastructure. According to Core Scientific, these specialized processors enable parallel processing capabilities that dramatically accelerate complex computational workloads. GPUs can simultaneously handle thousands of calculations, making them essential for machine learning, cryptocurrency mining, and advanced financial modeling.

The evolution of GPU technology has transformed traditional computing paradigms. Modern AI computing infrastructure increasingly relies on heterogeneous computing environments that combine multiple processor types. High-performance GPUs now integrate specialized tensor cores and advanced memory architectures designed explicitly for artificial intelligence and machine learning applications.

Quantum Processing Units (QPUs) represent the next frontier in AI computing infrastructure. Quantum Computing Research reveals two primary integration strategies: tight and loose coupling of quantum systems. Tight integration assumes resolving complex infrastructure challenges, while loose integration provides more flexible architectural approaches.

The performance of quantum-enhanced HPC architectures critically depends on quantum interconnect technologies. These specialized networking components enable entanglement between multiple QPUs, creating unprecedented computational possibilities. For cryptocurrency and financial modeling, quantum-enhanced infrastructure could revolutionize complex algorithmic trading and risk assessment strategies.

Advanced networking infrastructure forms the nervous system of modern AI computing environments. High-speed, low-latency interconnects are crucial for transferring massive datasets and maintaining real-time computational performance. According to the United Kingdom’s Strategic Computing Plan, achieving exascale computing requires a sophisticated, heterogeneous ecosystem that seamlessly integrates diverse computational resources.

Modern AI computing infrastructure must support rapid data transfer, distributed computing models, and complex computational workflows. This demands robust networking technologies that can handle petabyte-scale data movements with minimal latency and maximum reliability. Intelligent routing algorithms and advanced network management systems play a critical role in optimizing these complex computational environments.

The convergence of GPU acceleration, quantum processing capabilities, and intelligent networking represents the future of AI computing infrastructure. As computational demands continue to escalate across cryptocurrency, finance, and scientific research domains, these technological components will become increasingly sophisticated and interconnected.

To clarify the unique strengths of each core component, the following table summarizes the roles and features of GPUs, QPUs, and Networking Infrastructure within AI computing:

AI computing has become a transformative force in bitcoin mining and financial treasury management, driving unprecedented efficiency and strategic decision-making capabilities. The intersection of artificial intelligence and cryptocurrency infrastructure represents a critical evolution in how organizations approach digital asset management and computational resources.

Modern bitcoin mining operations increasingly rely on sophisticated AI algorithms to maximize computational efficiency and profitability. Advanced machine learning models can predict optimal mining strategies, analyze network difficulty fluctuations, and dynamically adjust mining configurations in real-time. These AI-driven approaches enable mining operations to minimize energy consumption while maximizing potential cryptocurrency rewards.

Energy management represents a crucial aspect of bitcoin mining infrastructure. According to Reuters, governments are recognizing the strategic importance of allocating dedicated energy resources for bitcoin mining and AI data centers. Intelligent energy allocation algorithms help mining operations optimize their power consumption, balancing computational intensity with sustainable resource utilization.

The U.S. Department of the Treasury has acknowledged the transformative potential of AI in financial services. Treasury Research highlights both the opportunities and potential risks associated with AI integration in financial decision-making processes. For cryptocurrency-focused organizations, AI computing infrastructure enables sophisticated treasury management strategies that go beyond traditional financial modeling.

AI algorithms can now perform complex risk assessments, predict market volatility, and generate nuanced investment strategies for cryptocurrency holdings. These advanced computational tools allow treasury departments to make data-driven decisions with unprecedented speed and accuracy. Machine learning models can analyze historical market trends, regulatory changes, and global economic indicators to provide real-time recommendations for asset allocation and portfolio management.

Cybersecurity represents a critical component of AI computing infrastructure for bitcoin mining and treasury operations. Intelligent threat detection systems leverage machine learning algorithms to identify potential security vulnerabilities, monitor transaction patterns, and prevent unauthorized access. These advanced computational approaches provide a robust defense mechanism against increasingly sophisticated cyber threats targeting cryptocurrency infrastructure.

The integration of AI computing creates a more resilient and adaptive financial ecosystem. By exploring advanced research methodologies, organizations can develop more sophisticated approaches to managing digital assets. Predictive analytics and machine learning models enable treasury teams to anticipate market shifts, optimize investment strategies, and maintain a competitive edge in the rapidly evolving cryptocurrency landscape.

As AI computing continues to advance, its role in bitcoin mining and treasury management will become increasingly sophisticated. The convergence of artificial intelligence, high-performance computing, and cryptocurrency infrastructure promises to unlock new possibilities for financial innovation and strategic asset management.

Artificial intelligence is fundamentally transforming financial markets and stock trading strategies, introducing unprecedented levels of computational analysis and predictive intelligence. The integration of advanced AI technologies enables more sophisticated, data-driven decision-making processes that challenge traditional investment methodologies.

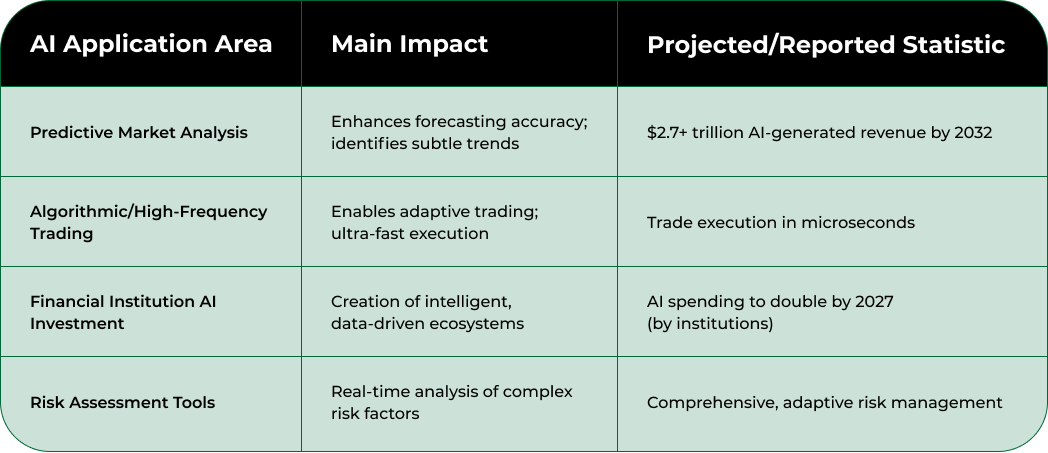

AI computing infrastructure has revolutionized financial forecasting through advanced machine learning models. According to Finance Research Letters, AI-generated revenue is projected to surpass $2.7 trillion by 2032, signaling a massive technological disruption in financial services. Sophisticated predictive models can now analyze complex market dynamics, identifying subtle patterns and potential investment opportunities that human analysts might overlook.

Foundation models and graph-based architectures are emerging as powerful tools for financial time series analysis. Advanced Research demonstrates how these sophisticated computational approaches can map intricate market relationships, enabling more nuanced and adaptive trading strategies. High-frequency trading platforms increasingly rely on AI algorithms that can process massive datasets and execute trades within microseconds.

Financial institutions are making substantial commitments to AI technologies. Finance & Development reports that financial organizations are projected to double their AI spending by 2027. This significant investment underscores the transformative potential of artificial intelligence in creating more intelligent, responsive financial ecosystems.

AI-powered risk assessment tools provide unprecedented capabilities for evaluating investment opportunities. Machine learning algorithms can simultaneously analyze historical market trends, current economic indicators, geopolitical events, and complex financial instruments. These computational approaches enable more comprehensive and dynamic risk management strategies that adapt in real-time to changing market conditions.

The table below summarizes some of the most transformative impacts AI is having on the finance and stock market ecosystem as described in the article:

The convergence of AI computing and financial strategies introduces a new paradigm of market intelligence. Intelligent trading algorithms can process vast amounts of unstructured data from diverse sources, including social media sentiment, news reports, and economic publications. By exploring advanced research methodologies, investors can leverage these sophisticated computational tools to gain competitive advantages.

Machine learning models excel at identifying non-linear relationships and complex market interactions that traditional statistical methods might miss. These advanced computational techniques enable more precise portfolio optimization, allowing investors to balance risk and potential returns with unprecedented accuracy. AI systems can simulate thousands of potential market scenarios, providing more robust investment strategies.

As AI computing continues to evolve, its role in financial markets will become increasingly sophisticated. The ability to process complex, multidimensional data in real-time represents a fundamental shift in how investment strategies are developed and executed. Financial professionals who effectively integrate AI computing infrastructure will be best positioned to navigate the increasingly complex global financial ecosystem.

High Performance Computing (HPC) has become a critical infrastructure for advancing computational capabilities in cryptocurrency and artificial intelligence domains. The convergence of these technologies demands sophisticated computational strategies that push the boundaries of traditional computing paradigms.

GPU technologies represent a cornerstone of modern HPC infrastructure for crypto and AI applications. Cutting-edge research reveals innovative approaches to maximizing computational performance, demonstrating the potential to dramatically enhance GPU capabilities through strategic source code modifications. By carefully adjusting instruction sets, researchers have achieved over 15 times the original floating-point performance, opening new frontiers in computational efficiency.

Specialized computing architectures are increasingly designed to address the unique demands of cryptocurrency and AI workloads. The ability to dynamically optimize computational resources allows for more efficient processing of complex algorithmic tasks, from blockchain validation to machine learning model training. These advanced approaches enable organizations to extract maximum value from their computing infrastructure.

High Performance Computing resources are revolutionizing AI model development through advanced optimization techniques. Research in Computational Optimization demonstrates the critical role of sophisticated search algorithms like ASHA (Asynchronous Successive Halving Algorithm) combined with Bayesian optimization. These approaches enable researchers to fine-tune AI models with unprecedented precision, leveraging the massive computational power of HPC systems.

The integration of HPC resources allows for more complex and nuanced computational approaches. Machine learning models can now be trained and optimized across massive distributed computing environments, breaking through previous computational limitations. This enables more sophisticated AI algorithms capable of handling increasingly complex computational challenges in cryptocurrency and financial technologies.

Emergent research is exploring innovative approaches to integrating blockchain technologies with high-performance computing infrastructures. Decentralized Computing Research proposes advanced federated learning models that utilize blockchain consensus mechanisms to optimize computational resource allocation. These approaches aim to minimize system latency by jointly optimizing critical parameters such as data offloading, transmit power, and computational resource distribution.

By exploring advanced research methodologies, organizations can develop more sophisticated approaches to distributed computing. Intelligent resource allocation algorithms enable more efficient utilization of computational resources across decentralized networks, creating more resilient and adaptive computing ecosystems.

The future of High Performance Computing lies in its ability to seamlessly integrate across cryptocurrency, artificial intelligence, and complex computational domains. As computational demands continue to escalate, HPC infrastructure will play an increasingly critical role in driving technological innovation. Organizations that can effectively optimize their computational resources will gain significant competitive advantages in an increasingly data-driven technological landscape.

AI computing infrastructure refers to the combination of hardware, networking, and computational resources that power advanced technologies such as artificial intelligence, finance, and cryptocurrency. This infrastructure supports complex processing tasks and enhances efficiency in these domains.

GPUs (Graphics Processing Units) are essential in AI computing as they enable parallel processing, allowing multiple calculations to occur simultaneously. This capability accelerates tasks in machine learning, cryptocurrency mining, and financial modeling, significantly enhancing performance and efficiency.

Quantum computing, through Quantum Processing Units (QPUs), offers advanced processing capabilities that can revolutionize complex algorithmic tasks in finance and cryptocurrency. QPUs can handle intricate calculations at unprecedented speeds, unlocking new possibilities in predictive analytics and risk management.

AI optimizes bitcoin mining by using machine learning algorithms to predict the best mining strategies, analyze network conditions, and dynamically adjust configurations. This maximizes profitability while minimizing energy consumption, leading to more sustainable and efficient mining operations.

Are you struggling with the complexity of setting up reliable AI computing for bitcoin mining or high-performance finance? The latest article has highlighted some huge headaches: unpredictable energy costs, the need for optimized GPU and quantum processing, plus the pressure to make smarter, faster treasury moves. If you want to tap into all the power of modern AI computing but avoid the stress and technical barriers, there is a simpler way forward. Explore how expert-hosted bitcoin miners, seamless Mining-as-a-Service, and proven ROI tools can help you stay ahead of crypto and financial innovation.

Do not wait while others move ahead with better infrastructure. Visit Blockware Solutions right now to learn how you can start mining bitcoin instantly, unlock professional HPC and AI support, and access deep industry research. Take the next step toward operational efficiency and a competitive edge—discover a partner who makes advanced computing easy.